We are known for our award-winning Junior ISA, but did you know you can also use Beanstalk to save and invest for yourself, whether or not you are saving for any children. Our ISA shares many of the same great features but not only that, it is one of the best value invest your spare change apps there is.

Rounding up your spare change to save or invest has become increasingly popular over the last few years with a few automatic saving apps available. Beanstalk offers an adult saver the same round up functionality but without the monthly fee many others charge.

The Beanstalk ISA for adult savers

The Beanstalk ISA is a stocks and shares ISA which lets you allocate your contributions in whatever proportion you choose between two funds: a Fidelity global tracker fund which aims to track the performance of global stock markets and an L&G money market fund which aims to provide a return in line with money market rates.

Any income or increases of value in an adult ISA are normally free of tax and you can contribute up to £20,000 into ISAs in any tax year.

Opening the ISA is simple and takes a minute or two: just download the Beanstalk app and click save for myself during the onboarding or set up ISA if you have already registered. You can open an ISA with an initial contribution of just £10.

The recent changes in ISA rules mean opening an ISA is even simpler as you can now contribute into multiple ISAs of the same type in any tax year.

Withdraw when you want

Although investing is best for the long term, with an adult ISA you can withdraw part or all at any point (it typically takes a few days to sell the investments and send the money to your bank account).

Use Round Ups to save little and often

As with our Junior ISA, there are lots of ways to make contributions to your ISA. You can set up a regular monthly contribution if you would like, or send one-off contributions in a number of different ways including our popular Instant Bank Transfer. (The only thing you cannot do is invite others to contribute to your ISA as HMRC rules don’t allow anyone other than the ISA account holder to make contributions to an ISA.)

Setting up Round Ups lets you round up purchases you make to the nearest £ and then automatically invest the amount you have collected each week. It’s a popular way to save little and often and with Beanstalk you can link multiple different bank and card accounts to round up.

You can still collect free cashback

You may not know that you can still collect free cashback on your shopping by clicking through to the KidStart offers on the app. Due to HMRC rules we are not allowed to pay this directly into your ISA but by clicking through to KidStart, you can set where you would like the cashback to go.

Our fees are competitive

The Beanstalk ISA has an annual fee of 0.5% of the value of the account which is deducted on a monthly basis. There are no fees for using the app, doing round ups or making contributions.

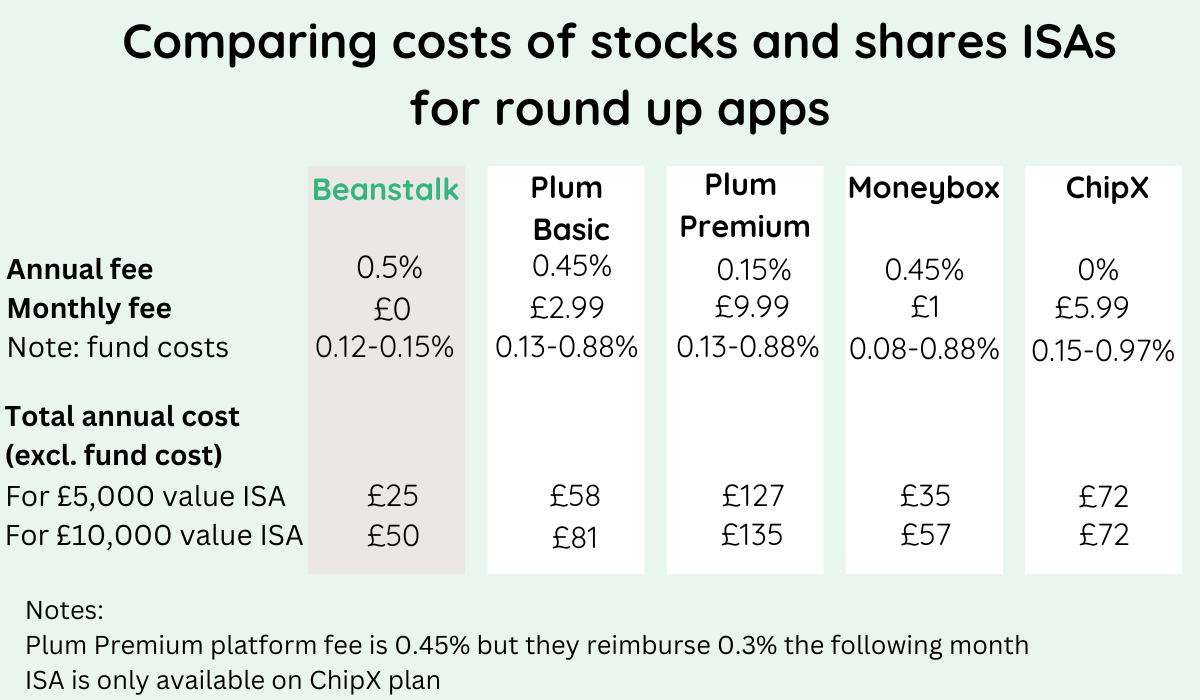

Other round up or auto save apps typically have a fixed monthly fee as well although the annual percentage charge can vary. We have shown the fees* for Beanstalk compared to Moneybox, Plum and Chip and used these to calculate the total costs for an account with a value of £5,000 or £10,000.

*Fees checked on competitor websites on 16th April 2024.

Transferring all or part of an existing ISA

Transferring all or part of an existing ISA to Beanstalk is a great way to take advantage of Beanstalk's features and potentially save money on fees.

If you would like to transfer an ISA, please complete the transfer form here and either email a scan to us, or send it via freepost to Freepost KidStart and we will take care of the rest.

To summarise, opening an ISA for yourself with Beanstalk is really simple whether you are saving for kids or not. It’s how I (and many others) use Beanstalk. My children are all now over 18, so I just have an ISA on Beanstalk with Round Ups enabled and I am building my own nest egg, which I may end up giving to them later anyway!